Fiat currency, or unbacked currency, such as the US dollar, is legal cash that receives its value from the issuing government rather than a physical object, unlike commodity currency. "Fiat is a Latin word that means "let it be done." Fiat money's value is determined by the government that prints it. Many countries today acquire commodities, services, investments, and deposits with Fiat currency. The gold standard and commodity money have been supplanted by this monetary system.

Fiat money's introduction

What is the definition of Fiat currency?

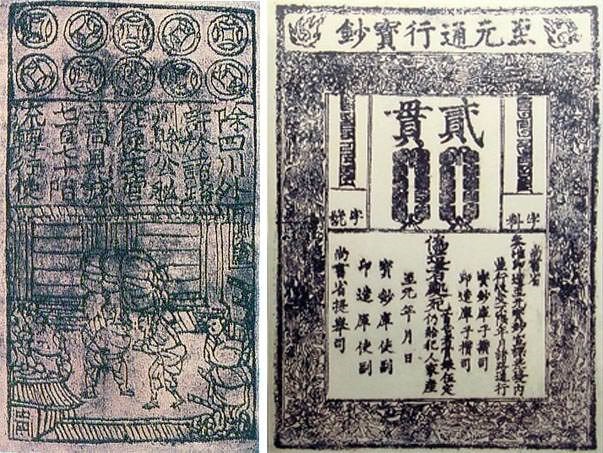

Fiat money originated in China in the 11th century, when Sichuan Province began to issue its own paper money. Initially, the money was turned into silk, gold, or silver. Eventually,

The US government switched to a commodity money system in the twentieth century, and from 1933 onwards, it stopped exchanging paper money for gold. The United States abandoned the gold standard in 1972, on the orders of then-President Richard Nixon, signaling the global decline of the supported monetary system employing fiat money.

Fiat money's advantages and downsides

What is the definition of Fiat currency?

Fiat currencies are favored by financial experts and economists. Fiat currencies have the following advantages and disadvantages, according to their supporters and opponents:

Scarcity: The scarcity of products or physical assets such as gold does not affect fiat money.

Fiat money is less expensive to produce than commodity money.

Fiat money makes the government and the central bank more responsive.

International exchanges: A huge number of countries worldwide use fiat currencies. This has made it possible to use money in commercial dealings.

Convenience: Unlike gold, fiat money is not held in physical reserves, which necessitates costly upkeep, preservation, and surveillance.

Fiat currencies are worthless because they have no intrinsic value. This permits governments to "produce money out of thin air," resulting in hyperinflation and the eventual collapse of a country's economy.

The use of the Fiat currency system has historically resulted in the collapse of financial systems, indicating the risk of adopting this monetary system.

Fiat money and electronic money.

Fiat cash and digital currency only have one thing in common: neither has a physical counterpart.

Fiat cash and digital currency have only one thing in common: neither has tangible backing. Digital currencies are decentralized, unlike fiat currencies, which governments and central banks regulate.

The way new currencies are created in each monetary system is a clear distinction. In comparison to Fiat currencies, which are controlled by banks and can be issued without any basis, Bitcoin, as the most prominent example of digital currency, has a restricted supply and quantity of coins.

Digital currencies have no tangible analogs and are not constrained by geographical limits. Furthermore, digital currency transactions are irreversible, whereas Fiat currency transactions are not.

The digital currency market is significantly smaller and more volatile than traditional markets and currency exchanges. This is one of the reasons why these currencies are so widely used and accepted around the world. However, as the digital currency market matures, it is likely to become less volatile.

Fiat currency benefits

The most important advantage of fiat currencies is the stability of their value. The value of these currencies is more stable than commodities such as gold, silver, and copper during recessions. For this reason, they are used to protect the economies of countries against repeated financial recessions.

Central banks can print and hold unsupported paper money if needed. In this way, more control over the money supply, interest rates, and liquidity in the country will be established. The Federal Reserve, for example, managed the financial crisis of 2008 by controlling the supply and demand of money in the United States and preventing further damage to the US financial system.

Another advantage of fiat currencies over digital currencies is that they are legal. Today, however, countries such as El Salvador have legally accepted bitcoin. But there is still a long way to go before global acceptance of digital currencies.

Preventing money laundering and drug trafficking are other benefits of this money. Because governments can easily control fiat currencies, it is not easy to make illegal transactions with fiat currencies.

Disadvantages

The biggest problem with fiat currencies is the severe inflation in the country due to the uncontrolled printing of money. The first government to use fiat money collapsed due to inflation! The Yuan Dynasty was the first government in China to use unsupported paper money. Their money is said to have had a fixed value over gold, but in practice, the government never allowed money to be exchanged for gold.

Kublai Khan, the founder of the Yuan Dynasty, worked hard to curb inflation caused by money printing, but all his efforts were in vain.

Every year, we see a lot of money being injected by banks into economic markets. This injection of unsupported money, if accompanied by mismanagement, paralyzes the economy of any country.

Another disadvantage of fiat money is the concentration of power in the hands of governments and financial institutions. This centralism has led to the over-empowerment of governments. They can control all your financial transactions. Even the value of the money in your hands varies depending on the decisions of politicians. We should trust governments and banks when we build our lives on fiat money. We trust the government to make money, the banks to keep it, and the big financial institutions to value our money. However, history shows that most of these organizations are not very reliable.

In such a system, citizens have little control over their money and practically become nutshells for politicians. A government can reduce people's purchasing power and expand poverty by creating inflation. This issue is entirely related to the policies and policies of the government.

In societies where transactions are made with fiat money, there is little freedom and flexibility in trading and markets because everything is under the magnifying glass of the law.

Conclusion

Any currency system's future is unclear. While digital currencies still have a long way to go and face numerous challenges, history has demonstrated that fiat currencies are fragile.

One of the main reasons why some people are switching to digital currency systems and using them in financial transactions is because of this.

The discovery of Bitcoin and digital currencies is one of its fundamental concepts.

The discovery of a new kind of money on decentralized and peer-to-peer networks is one of the key principles behind Bitcoin and digital currencies. As an alternative economic network, Bitcoin has the potential to play a significant role in the future of the global economy.