The definitive guide to different types of analyses in cryptocurrency and financial markets

One of the most important things you can do is learn about the different types of analyses in cryptocurrency and financial markets. Many traders and investors are employing these strategies to understand the market better. Goldman Sachs, JP Morgan, and Morgan Stanley have all issued bullish investment reports based on fundamental analysis. Models constructed by on-chain researchers estimate bitcoin's price will reach $1.9 million by 2025. There are three main categories of cryptocurrency analysis: fundamental, technical, and on-chain analysis, and then we will take a brief look at types of financial analysis.

Fundamental analysis | types of analyses

One of the most appreciated types of analyses, a crypto's fundamental analysis entails sifting through all publicly available data. Here we use a combination of quantitative and qualitative financial metrics. Finally, the goal of fundamental analysis is to evaluate the intrinsic value of a coin. To determine if a crypto asset is undervalued or overvalued, you must first determine its basic worth. Investment opportunities might arise when undervalued assets, while overvalued ones indicate that it is time to take profits.

Is there any intrinsic value in a meme coin like Dogecoin? Dogecoin doesn't have fundamental value. The techniques of fundamental analysis, on the other hand, give us additional information. What exactly is Dogecoin? In the first place, a lack of a roadmap, developer team, and even a whitepaper are obvious flaws. Despite this, it has a market value in the millions, a 24-hour volume in the millions, and is among the most well-known cryptocurrencies. It's obvious that it's worth something and might be a terrific investment opportunity.

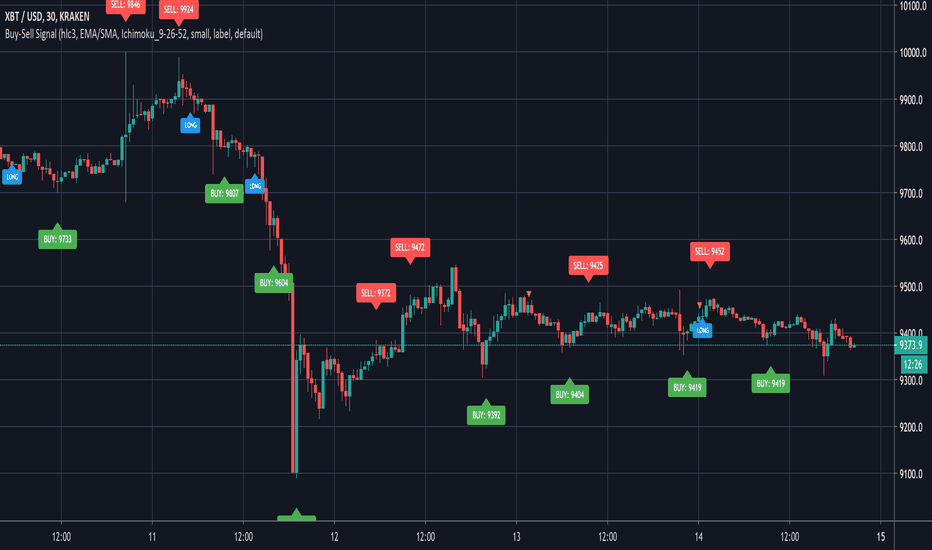

Technical analysis

Among types of analyses, if you want to predict the market's direction, technical analysis studies previous price movements. Is it increasing? Down? Sideways? For each scenario, the technical analysis relies on various data indicators and trends. While traders rely largely on statistical measurements, they employ visual charts to recognize critical indications, such as support and resistance. In the end, buy and sell signals are found using technical analysis.

It's crucial to keep in mind that traders who use technical analysis don't always expect to be right. A trader can make money even if they are correct only 55% of the time. Setting auto-sells and only investing a percentage of their holdings in one trade are two risk management methods used by traders to minimize the danger of losing money in times of market uncertainty In summary, analysts use technical trading methods to forecast that the market will most likely continue to rise while there may be a brief price decrease in the short term.

On-chain analysis | types of analyses

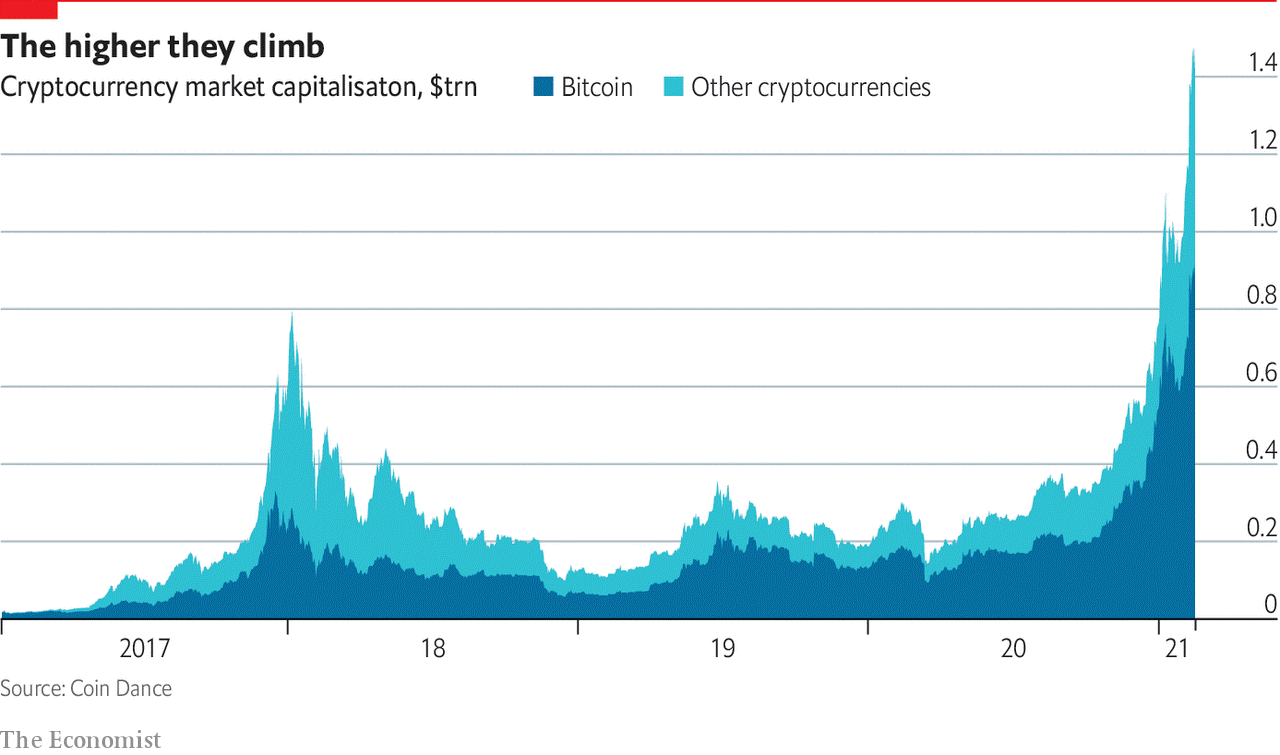

Unlike other types of analyses, the public data on the blockchain is the focus of on-chain analysis. For bitcoin traders, it's an emerging field that can help them better predict market movements and evaluate investor emotions. In the end, traders employ on-chain analysis to determine the reasons for different market participants to purchase and sell, such as miners selling to pay their bills or investment firms profiting from the market. Market participants like institutional investors, exchanges, miners, and retail dealers can all be tracked via on-chain research. Coin dormancy and transaction volume are among the signals they employ.

Financial types of analyses

A financial analyst reviews an organization's financial data to make business decisions. It's possible to employ this analysis in various ways, each with a specific purpose. Following is a list of financial types of analyses.

Horizontal Analysis: A part of this process is to compare an organization's financial outcomes over several successive reporting periods. The aim is to identify any data spikes or drops that could be a starting point for a more in-depth investigation into financial performance.

Vertical Analysis: The income statement's various expenses are evaluated as a percentage of net sales. For the balance sheet, the same method can be utilized. These percentages can be investigated further if they aren't consistent over time.

Liquidity Analysis: An in-depth look at working capital, including accounts receivable, inventory, and accounts payable turnover rates. Working capital is a major user of cash. Thus any deviations from the long-term average turnover rate warrant additional investigation. Strategic and tactical changes to an organization's operations might affect its liquidity levels, which is something to keep an eye on if the company lacks fast access to new funds.

Profitability Analysis: This looks at how much money a company makes. There are other ways to break down the profits: by product or line, by region, by a subsidiary, by store, etc. Profitability analysis of the business as a whole is most likely all that is done for a smaller company with fewer products. Decisions on changing pricing points, product configurations, eliminating overhead costs, and so on may result from this analysis.

Multi-Company Comparison: The key financial ratios of two companies, usually from the same industry, are calculated and compared in this exercise. By comparing the financial accounts of the two companies, this study aims to establish the relative strengths and weaknesses of each one. If you're an acquirer, this is especially beneficial for determining the most promising purchase targets in a given industry.

Industry Comparison: Comparing one company's financial results to an entire industry might be compared to a multi-company comparison. The goal is to see if any outcomes are out of the ordinary compared to the norm. If there are favorable variances, it may be because of its distinctive strategic orientation.

Valuation Analysis: A variety of techniques are used to develop a range of possible valuations for a company. Discounted cash flow valuation, a comparison to the prices at which comparable companies have been purchased, and the compilation of the values of its subsidiaries and individual assets are only a few examples of these methodologies.

Cryptocurrency trading can be made more profitable by combining various analysis methods

In addition to their own merits, combining these types of analyses yields greater results. A single metric may be ineffective on its own. You may construct a compelling picture of the market by combining all of your analysis approaches but remember, in trading, the convergence of all analysis methods is not a must.