The ultimate guide to using fundamental analysis for cryptocurrency market

Before investing in cryptocurrencies, a thorough investigation and evaluation of all available metrics are necessary. Token economics, the creators' background, and the currency's current state of development are all common topics covered in most projects. Using Fundamental Analysis, you may understand how the cryptocurrency market is doing.

Many newcomers believe that cryptocurrencies can't be valued using Fundamental Analysis because of their high volatility. The asset's value can still be determined, even if it is subject to the whims of global traders. To determine if a cryptocurrency is worth buying or selling, you need to understand fundamental analysis. Using fundamental analysis, we'll show you the ins and outs of analyzing cryptocurrencies and how they differ from traditional asset types like stocks and bonds.

What Is a Fundamental Analysis?

The goal of Fundamental Analysis is to arrive at an objective assessment of an asset's value. To determine whether a legit or non-legit cryptocurrency is undervalued or overvalued, it is necessary to analyze the project's underlying data. As previously said, the cryptocurrency market is extremely unstable. Even well-established currencies like Bitcoin and Ethereum are susceptible to sudden price changes. The risk of investing in newer coins and tokens is substantial unless you are well-versed in the subject matter. Non-technical investors and experienced traders can confidently trade the market using fundamental analysis. When traders are armed with fundamental research, they have a better chance of making money.

You Can Use Fundamental Analysis in Three Main Methods

The primary objective of the fundamental cryptanalysis is to limit investment risk and analyze the asset's profitability.

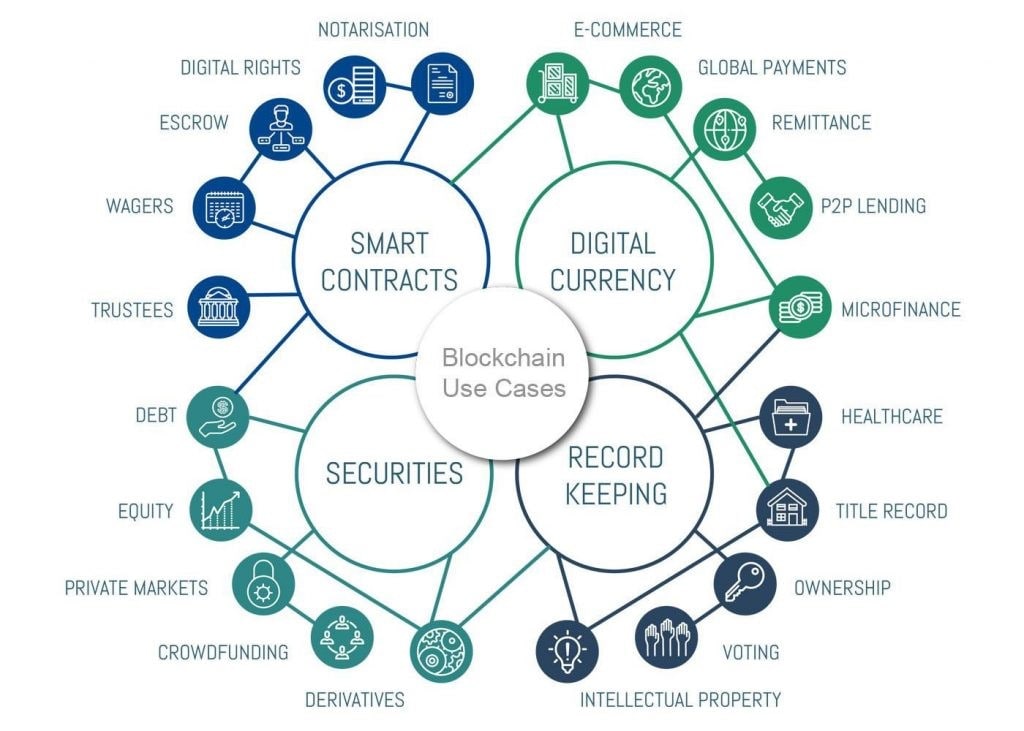

Blockchain Metrics (On-chain Metrics)

Blockchain is an excellent resource for crypto Fundamental Analysis. However, it requires a significant amount of time and resources to extract information from the raw data. Appropriate tools for making investment decisions can be found in various application programming interfaces (APIs). Exchanges have developed reporting systems that provide useful data, such as the number of active users, total transactions, and transaction value. Leading cryptocurrency exchanges have developed these tools. As part of a cryptocurrency's fundamental study, hash rate, status, and active addresses are the three most important indicators. Transaction values and fees are other important data. Look at how this data can help you make better trading decisions.

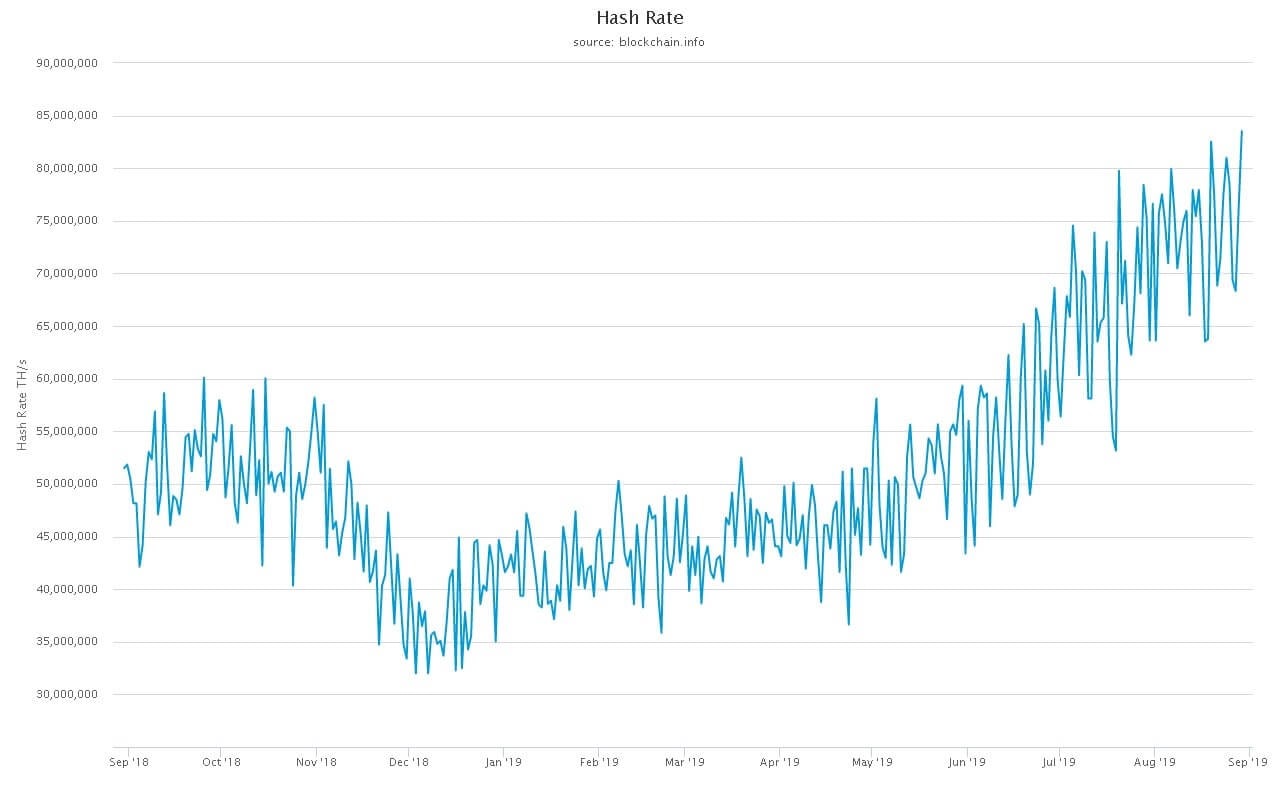

Hash Rate

For crypto Fundamental Analysis, the blockchain serves an important function in protecting the network. The Proof-of-Work (PoW) blockchains of Bitcoin and Ethereum are two instances of cryptocurrencies. For PoW to work, crypto miners must solve a computational puzzle that verifies every transaction while preventing hostile attackers from attaining 51% of the blockchain's majority. Doing so would permit the controlling entity to change or block other transactions that do not belong to them or even double-spend their own currency. The total computing power used in a PoW blockchain's mining process determines the network's hash rate. The real hash rate can only be inferred from data made available to the public. For many cryptocurrency investors, hash rates indicate the coin's viability. The network is more secure because miners are more motivated to mine for profit when the hash rate is higher. Personal hash rates can assist miners in assessing their profitability.

As the hash rate decreases, miners may find the coin unprofitable, resulting in miners' abandonment. When markets plummet, it's common for miners to liquidate their rigs in a show of weakness. Lower hash rates are a sign that investors are losing interest.

Status and Active Addresses

The total number of active blockchain addresses over a given time is referred to as "active addresses" in the Fundamental Analysis. Sending and receiving addresses can be summed up by dividing the total by the number of times they've been used. Compare the growth or drop in the number of active addresses over days, weeks, or months to determine the level of interest and activity in the coin or token. Another method is to add up the total number of different addresses over a set period and then compare the numbers.

Other Considerations for Fundamental Analysis

Value of the Transaction and the Fees Involved in Fundamental Analysis

Analysis of transaction values is given greater weight in Fundamental Analysis than in technical analysis. Five $250 transactions on the same day would total $1,250 in daily transaction value. Currency in stable circulation shows up as a continuously high transaction value, and market comparisons give information about possible future market moves. For example, fees show how many transactions are paying to be put as rapidly as possible on the blockchain. All cryptocurrencies include transaction fees, and Ethereum's gas is an example. Fees paid over time give you a notion of the coin or token's security. Due to the difficulty of mining and block subsidy, transaction costs are likely to rise over time. Without a change in the payout, miners would stop mining, and the blockchain would begin to fall apart.

Financial Metrics in Fundamental Analysis

Investors use the numerical value generated by Fundamental Analysis to assess an asset's future prospects. Understanding the trading conditions of crypto assets, including their liquidity, surrounding factors, and market reaction, is an important part of appraising crypto financially.

A thorough understanding of crypto Fundamental Analysis can help investors make informed decisions before investing.

Market Cap in Fundamental Analysis

In financial terms, the market capitalization value represents the worth of a network. Multiplying the current price by coins in circulation yields this answer. Other variables, like liquidity, should be considered when using market capitalization to arrive at an accurate valuation. Just though there are 50 million coins in circulation, and only one or two transactions have been made at $1, it doesn't mean that each coin is worth the same amount. Investors may feel that coins with a lower market capitalization have greater growth potential, while higher market capitalizations can also indicate a more solid foundation and long-term viability. The market capitalization of a coin provides an approximation of the coin's network value, even though we will never know exactly how many coins are in circulation.

Bottom Line

Traditional ways of valuing cryptocurrencies justify their trading prices as institutional demand grows. It's a little more difficult to learn about Fundamental Analysis in crypto than in traditional markets, but the resources available are also growing. Crypto trading bots, liquid exchange platforms, and engaged communities contribute to a healthy ecosystem. Make sure you do your homework before investing in any token. It is possible to make a fortune in cryptocurrency markets if you devote time and effort to thorough research and fundamental analysis. Investment risk can be reduced with the right information and analysis. As a result, do your research and broaden your investment horizons.