In the world of digital currencies, you have probably come across the so-called decentralized or the phrase that digital currencies are decentralized, but do you know exactly what "decentralized" mean? In this article, we will address this issue.

Super-decentralized solution

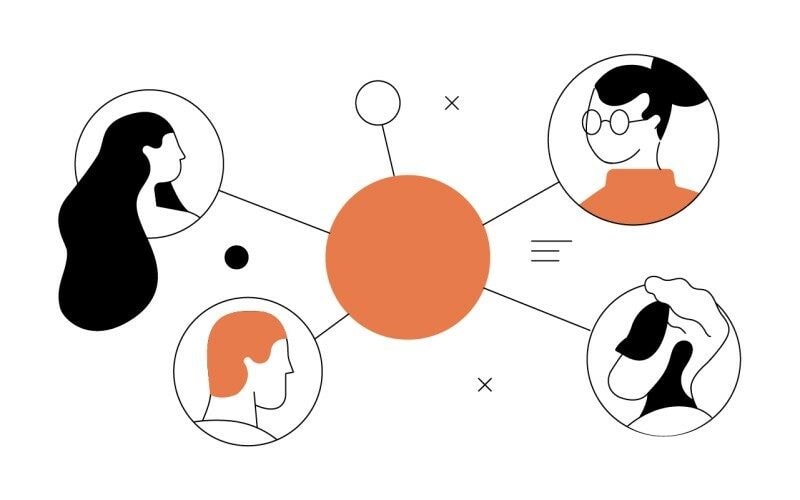

With the advancement of technology, a new idea was introduced which stated that since everyone has access to the Internet today, why aren't people in direct contact with each other? Do not take each other's service and do not serve each other? It is not necessary to use the space of a centralized server, but everyone can be both a server and a client directly by providing their resources (for example, a hard drive or CPU). For example, suppose you download the song you want from someone's hard drive and it downloads the file from your hard drive.

BitTorrent is the first decentralized product

The first popular decentralized product was BitTorrent, a protocol in which everyone is both a client and a server. This platform allows you to download and upload files, according to this protocol, for example, if a person wants to download a movie, he can connect to a person anywhere in the world who has this movie and download it. The file can be uploaded while it is downloading, and other people can download and download the file from you, which means that in addition to downloading the movie and receiving the service, you are uploading the file to You serve the rest.

Decentralized is a distinctive feature of digital currencies.

So far, introductions have been made so that we can more easily understand the decentralized meaning. Decentralized simply means that information does not exist in the hands of a particular entity and is not centralized, but the information is scattered throughout the network and a set of network members are in charge of the network. Now it is better to deal with the issue of the decentralization of digital currencies.

What is a decentralized digital currency and what are its benefits?

There are a variety of investment markets for maintaining and raising capital, some of which are very old and somehow well known to the public. However, in recent years, many investors have moved to the digital currency market. The reason for this is the unique features of this market compared to other investment markets.

Why is digital currency a good market for investment?

The digital currency market, like any other method, has its profitability and risk. However, the features provided by the technology world to this market have made it possible for different actors to invest in this field. One of these characteristics is decentralization. The term refers to the possibility of direct communication and trading of investors in the market without any restrictions. With this possibility, there is no need to make a transaction through centralized exchanges.

For example, there are a variety of online markets today that use digital currency. Decentralized markets use a variety of digital devices to communicate with investors and display instant prices. In such cases, there is no need for the buyer, seller, and trader to be present in the same space at the same time.

What is security like in decentralized digital currencies?

Because everything in this market is managed through digital devices, in a decentralized market, digital technology is used to create a safe environment for buyers and sellers to trade directly with each other without the need for traditional exchanges. If we want to illustrate the point, real estate agents are a good example. In these places, it is possible to trade directly between the buyer and the seller. The main issue in this regard is the Chinese blockchain system. Blockchain is a technology used for digital currency. One of the features of this technology is decentralization. This means that block processing and storage locations are not necessarily fixed, and this data can exist at various points.

The advent of this technology created the opportunity to create decentralized markets. Traders in this market are satisfied with the security of these transfers. However, it is also possible to establish regulations in this regard to increase the security of these transactions by imposing restrictions.

Is decentralized digital currency unprecedented?

The history of decentralized markets is not limited to digital currency, and the history of these markets has been seen before. One of the most popular of these decentralized markets is Forex. In the Forex system, there is practically no physical place for traders to go and trade currency. Forex investors use the Internet to examine the prices of currencies and trade directly with traders around the world.

In the case of the digital currency market, investors refer to the online digital currency exchange to view the instantaneous price of currencies and to buy and sell directly.

What is a decentralized digital currency?

Decentralized currency is generally a method of transferring currency without the need for a bank, through which capital can be transferred without the need for a third party in the transaction. Decentralized digital currency is commonly used in virtual markets and is traded using the facilities provided by digital currency exchanges.

The Advantages of Decentralized Digital Currency

Because there is practically no source of information that they can access, indirect markets are safe from hackers. Decentralized markets create a transparent and secure environment between the parties to the transaction. In addition, the use of appropriate technology in these markets can increase the confidence of both parties. Also, some users see the lack of multiple and cumbersome rules as an advantage for this system, because in a free trade environment, they can easily trade. In addition, eliminating intermediaries from current transactions in decentralized markets can reduce transfer costs.

Due to the independence of this market from banks, transactions in this market are not conducted under the banking laws of any country. Also, this market will not be harmed by the bankruptcy and liquidation of banks, and the decentralized digital currency will not be affected by inflation or the devaluation of the currency.

Trading in a decentralized market is done internationally and freely, regardless of borders, and it is possible to trade with low amounts and without restrictions. You also do not need any special knowledge to enter this market, and if you are familiar with working with virtual wallets, you can transfer your assets through an online exchange.

Decentralized digital currency disadvantages

Due to the free market and lack of supervision by higher institutions, there is no legal framework to monitor and support activists in this field, and in the event of any problems, it will not be possible to file a complaint to realize the lost right. Also, due to the lack of focus in this market, there is no clear path to move and invest in this market. Interestingly, unlike the client-server system, the network does not weaken as the number of people increases, or the so-called server does not become inaccessible, because first of all there is no centralized server and the files are on people's computers around the world (i.e. decentralized). And its members who monitor and control this network. Secondly, with the increase of people, this network becomes stronger, because the number of clients, who are also servers, increases. In practice, the life of this system depends on its members, who communicate with each other on a peer-to-peer basis.